The Impact of China's Policy Change on the Solar Industry

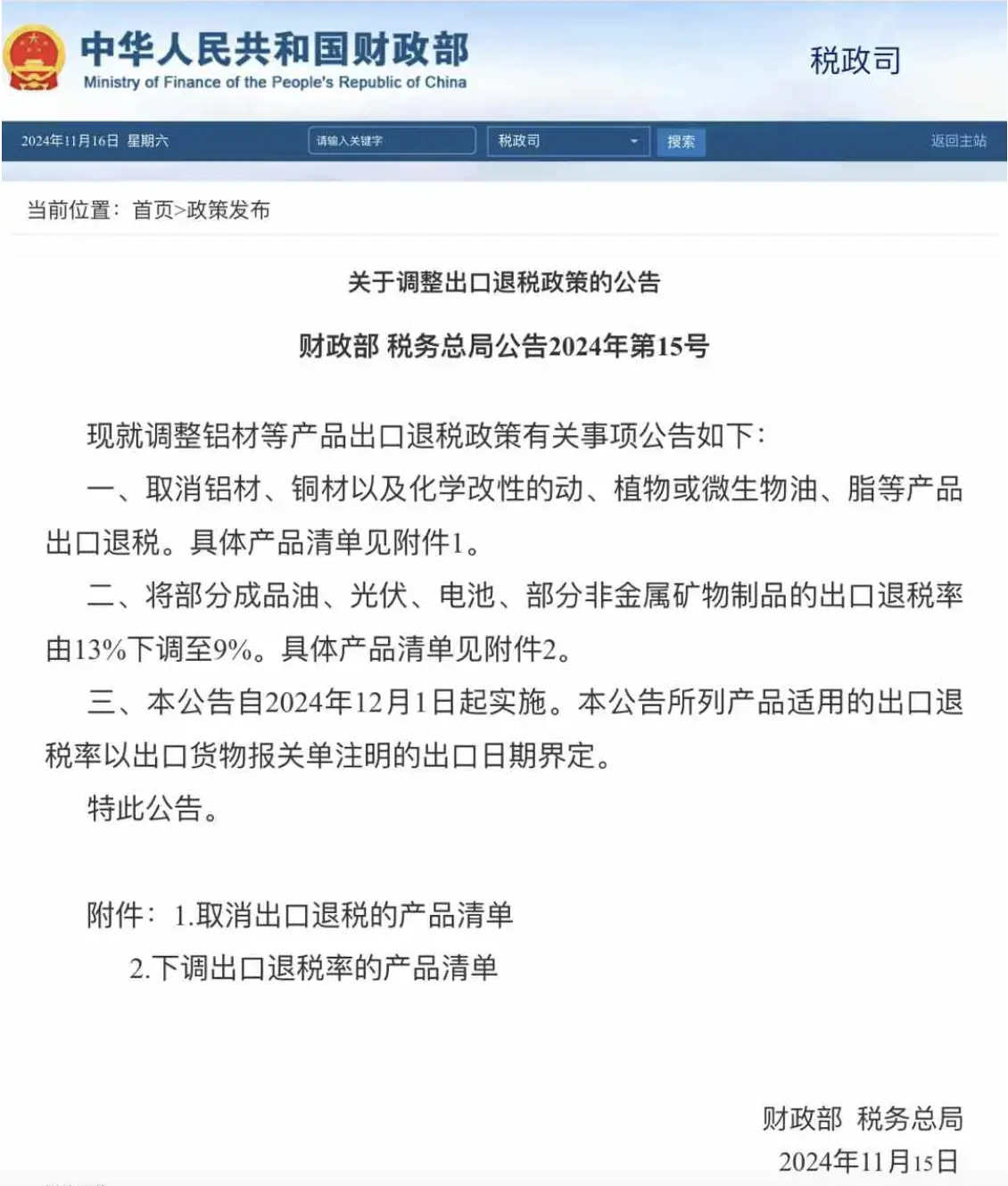

Recently, China announced a reduction in the export tax rebate for solar products, including silicon wafers, cells, and modules, from 13% to 9%. This move is part of a broader effort to adjust the photovoltaic (PV) industry’s dynamics and consolidate China’s “absolute advantage” in the global solar market. The policy shift aims to phase out the reliance on export rebates, which, while beneficial in the past, can prevent long-term growth and innovation.

Recently, China announced a reduction in the export tax rebate for solar products, including silicon wafers, cells, and modules, from 13% to 9%. This move is part of a broader effort to adjust the photovoltaic (PV) industry’s dynamics and consolidate China’s “absolute advantage” in the global solar market. The policy shift aims to phase out the reliance on export rebates, which, while beneficial in the past, can prevent long-term growth and innovation.

1. The Effect of Tax Rebate Removal

The most immediate impact of this tax rebate reduction is a significant financial burden on solar companies, particularly those reliant on export rebates to maintain cash flow. With export rebates contributing nearly $3 billion to the solar industry’s revenue, this reduction means a direct loss of $1 billion, forcing many companies to adapt. In addition, the reduced rebate will lead to higher production costs, making solar products more expensive for international buyers and potentially reducing the global competitiveness of Chinese exports. In the short term, the increased tax burden may lead to margin compression for manufacturers, with the potential for further price increases in international markets.

2. Why is the Government Doing This?

The Chinese government’s decision to cut export rebates is a strategic move to foster a more competitive, self-sustaining solar industry. By reducing dependence on subsidies, the industry will be forced to innovate, improve efficiency, and focus on higher-quality products. This aligns with China’s long-term goal of leading the global transition to renewable energy while also ensuring that its solar companies can thrive in competitive international markets without relying on artificial price advantages.

3. Impact on Export Prices and Profit Margins

In the medium to long term, this policy shift is expected to drive up the export prices of solar panels, bringing them back to more reasonable profit levels. Currently, Chinese solar products are priced close to or below production costs due to the subsidies. The reduced tax rebate will help align prices with actual production costs, which is unsustainable at current low levels. This adjustment may also lead to price stabilization in international markets, where Chinese solar products will be priced more competitively based on quality rather than subsidies.

4. A Call for Innovation and Adaptation

With the reduction in rebates and increased competition, Chinese solar companies must adapt by focusing on innovation. The pressure to maintain profit margins will push companies to invest more in research and development, improving efficiency and lowering costs through technological advancements. This, in turn, will enhance their competitiveness in the global market and allow for higher-quality, more durable solar products.

Conclusion

As China moves to reduce its reliance on export tax rebates, the solar industry must adjust to a more competitive and self-sustaining environment. While this policy change may create short-term challenges, it will ultimately lead to a stronger, more innovative solar industry that can thrive without relying on government subsidies. By raising prices and improving technological advancements, Chinese solar companies will maintain their leadership in the global renewable energy market.